What are the Timeline Requirements for a 1031 Exchange?

1031 Exchange Requirements

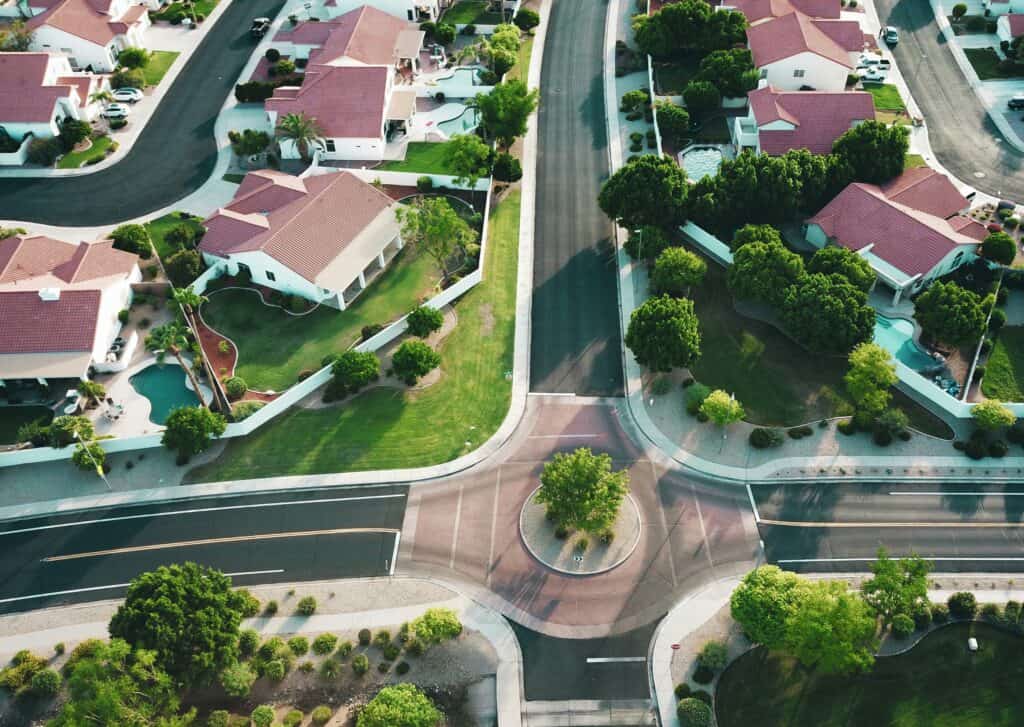

We specialize in helping investors navigate the complex timeline requirements for 1031 exchanges in Bend, Oregon and beyond. A 1031 exchange allows real estate investors to defer capital gains taxes when selling investment properties and acquiring like-kind replacements. The two key timeline requirements are the 45-day identification period and the 180-day exchange period, both of which begin on the day the relinquished property is sold.

Understanding these strict deadlines is crucial for a successful exchange. The 45-day window gives investors a limited timeframe to identify potential replacement properties in writing. We recommend our clients in Bend start researching options well before selling their relinquished property to maximize this period. The 180-day exchange period is the total time allowed to complete the entire transaction, including closing on the replacement property.

1031 Exchange Timeline

A 1031 exchange involves strict timelines that must be followed to ensure compliance with IRS regulations. Understanding these critical timeframes is essential for a successful exchange.

Critical Timeframes and Deadlines

The 45-day identification period begins on the day the relinquished property is sold. During this time, you must identify potential replacement properties in writing. You can choose up to three properties of any value or follow the 200% rule, which allows identifying more properties if their total value doesn’t exceed 200% of the relinquished property’s value.

The 180-day exchange period starts simultaneously with the 45-day period. You must acquire the replacement property within 180 days of selling the relinquished property. This deadline is crucial and cannot be extended, even if it falls on a weekend or holiday.

IRS Guidelines and Compliance

IRS guidelines require strict adherence to these timelines. You must use a qualified intermediary to hold the proceeds from the sale of the relinquished property. The intermediary will prepare the necessary exchange documents, including Form 8824, which must be filed with your tax return.

Compliance with identification rules is critical. You must provide an unambiguous description of the potential replacement properties. This typically includes the property address or a legal description if available.

Working with a tax advisor or CPA is recommended to ensure all IRS regulations are met. They can help navigate the complexities of 1031 exchanges and maintain compliance throughout the process.

Identification Period Specifics

The identification period for a 1031 exchange in Bend begins on the day you sell the relinquished property and lasts 45 calendar days. During this time, you must identify potential replacement properties in writing to the qualified intermediary.

You can use one of three rules for identification:

1. Three-Property Rule: Identify up to three properties of any value.

2. 200% Rule: Identify any number of properties, as long as their total value doesn’t exceed 200% of the relinquished property’s value.

3. 95% Rule: Identify any number of properties if you acquire 95% of the total value identified.

It’s crucial to provide an unambiguous description or the legal description of each property. We recommend including the property address and estimated market value to avoid any confusion.

Setting Investment Goals with 1031 Exchanges

1031 exchanges can be powerful tools for achieving various investment objectives. Common goals include:

Portfolio diversification

Increasing cash flow

Consolidating multiple properties

Relocating investments to different markets

We help investors analyze their current holdings and future aspirations to develop tailored exchange strategies. This may involve identifying properties with higher appreciation potential or exploring new asset classes.

Tax deferral is a key benefit, but it’s crucial to align exchanges with long-term investment goals. We work closely with clients to ensure their 1031 strategies support their overall financial plans and risk tolerance.

Ready to Elevate

Start Your Tax-Deferred Exchange Journey Today

Contact us to learn how we can help you maximize your investment potential and achieve your real estate goals.